Bangladesh will settle its pending payments to Russia in Chinese yuan instead of dollar. Dhaka will settle repayments worth $110 million to Moscow for the currently under construction Rooppur power plant in the Chinese currency, it was revealed.

The development came amid increasing de-dollarisation efforts by the developing nations and calls by BRICS [Brazil, Russia, India, China and South Africa] nation members for a common BRICS currency.

Russia has been barred from much of the international banking system, due to the US-led sanctions in-place. After months of scrambling for ways to settle repayments, last week, a high-level delegation from Russia and Bangladesh’s Ministry of Finance agreed that the bills could be paid in yuan.

Because of the sanctions against Russian banks, we couldn’t process payments in U.S. dollars. Russia asked us to settle the payments in their currency, rubles, but that was not feasible. So we both opted for yuan,” Uttam Kumar Karmaker, additional secretary of the Bangladesh’s finance ministry’s Economic Relations Division (ERD), was quoted as saying by Nikkei Asia.

The Rooppur power plant, once completed, will be capable of generating 2,400 megawatts of power. It is to be a crucial element of Bangladesh’s plans to generate more energy and reduce its reliance on coal

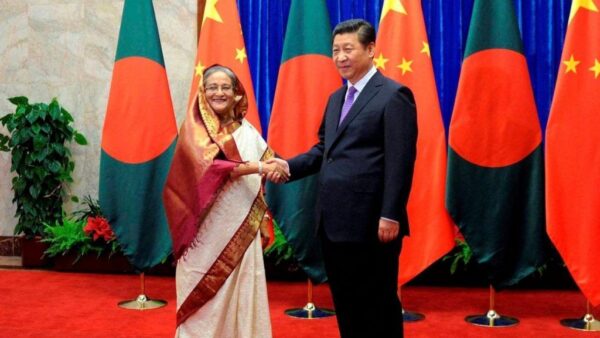

Bangladesh’s Chinese currency pact to settle payments with Russia

Bangladesh will resolve payments with Russia via a Chinese bank, likely drawing on Dhaka’s own reserves of yuan. Russian beneficiaries will receive funds through China’s Cross-Border Interbank Payment System (CIPS), a yuan-driven alternative to the dollar-dominated SWIFT system.

US-led sanctions against Russia a boon for China

The US-led sanctions targeting the SWIFT access to some Russian banks has reportedly opened doors for China to promote its alternative. Beijing has found an eager partner in Russia, one of the world’s top energy exporters.

In late March, during a three-day bilateral summit with Chinese President Xi Jinping, Russian President Vladimir Putin said, “We are in favor of using the Chinese yuan for settlements between Russia and the countries of Asia, Africa and Latin America.”

Bangladesh’s central bank has been building up the share of yuan in its foreign currency reserves since 2017, after the currency was included in the International Monetary Fund’s Special Drawing Rights (SDR) currency basket.

In September last year, Bangladesh Bank issued a circular allowing commercial banks to maintain accounts in yuan with their corresponding branches abroad to settle cross-border transactions.

Experts cited in the media say that Bangladesh has not adopted a deliberate policy to build up yuan reserves.The yuan’s portion of the country’s forex reserves rose to 1.32 per cent last August, from 1 per cent in 2017, while the dollar declined to 75 per cent from 81 per cent, according to data cited by Nikkei Asia.