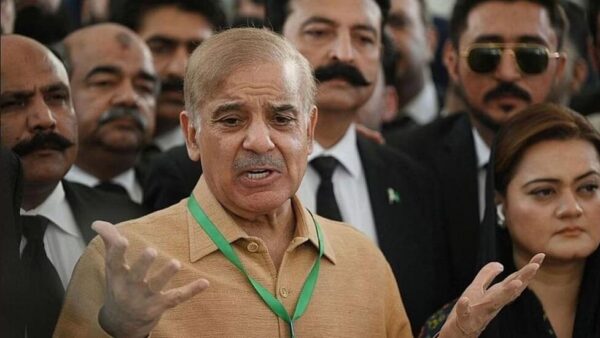

The impasse among the Shehbaz Sharif authorities and the International Monetary Fund over the $6 billion bailout has simplest improved the severity of the monetary disaster in Pakistan. The fee of the Pakistani rupee has plummeted to an all-time low; inflation quotes are soaring in double digits,

and the country of Pakistan`s worldwide change is hard its restricted reserves of bucks. In the primary week of February, Islamabad`s foreign exchange reserves had been at the bottom in 9 years; analysts stated it covers much less than 3 weeks of imports.

On 1 January 2023, one US greenback ought to purchase PKR 226.55. By 7 February, the Pakistani rupee had depreciated through extra than 17 in keeping with cent to attain PKR 275. Around the identical time in 2022, a greenback ought to purchase PKR 175.

In August 2018, whilst Imran Khan become the PM, one greenback become really well worth PKR 123. Even below Shehbaz Sharif`s Pakistan Muslim League (N), which took over in April 2022, the Pakistani rupee has endured to depreciate. And this provides big strain on its forex reserves as well.

According to the State Bank of Pakistan (SBP), the us of a become left with simplest about $8.five billion of forex reserves through three February, down from $23.7 billion closing year. Currently, $2.nine billion is with the SBP and the relaxation with industrial banks.

To restoration its plummeting forex reserves, Pakistan desires to earn bucks – overseas change stability is available in accessible if the us of a exports extra than it imports. However, Pakistan doesn`t take a seat down in that candy spot either.

Balance of payments, worldwide change

Pakistan`s change deficit worsened withinside the aftermath of the pandemic. In 2020, its exports of products had been really well worth $21.nine billion in opposition to imports valued at $forty four billion. SBP`s provisional records launched closing month suggests that through the give up of 2022, Pakistan`s exports had improved to $31 billion—however so did its imports to $sixty six billion.

Unlike India, Pakistan doesn`t have a great deal positivity in its change of offerings either,. in which the deficit has been exceedingly strong for the beyond three years at $2.five to $three billion. It is thru secondary earnings that Pakistan`s cutting-edge account stability receives cushioned.

According to the IMF, the secondary earnings account suggests cutting-edge transfers among citizens and non-citizens. These are majorly remittances from abroad, which aren’t intended for long-time period funding purposes.

Detailed data on this specific account display that maximum of the bucks earned through Pakistan come from Non-Profit Institutions Serving Households (NPISHs). These charity establishments serve the needy and offer about $31 billion to Pakistan.

Pakistan`s cutting-edge account deficit stands at around $12 billion — the best in view that 2018 ($14.6 billion). All those elements have pressured the us of a to are looking for assist from the IMF, whose assembly with the us of a`s officers concluded closing week.