Real Estate Investment and Bitcoin

At the point when societies made a method for trade: cash, the worldwide economy developed into its ongoing confounded structure. What we require for conceded now is the consequence of hundreds of years of communication. Cash has no characteristic worth, however its compatibility, movability, and unwavering quality give it esteem. As innovation propels, the method for exchange, as digital currencies, is likewise developing. Cryptographic forms of money are computerized monetary standards that manage exchanges through a decentralized framework. The most notable cryptocurrency, Bitcoin, has become related with the term cryptocurrency. This blog researches the impact of Bitcoin on real estate investing.

Dread That Bitcoin Would Drive Away Investment from Real Estate Is Exaggerated

There are fears that real money might disappear. As per one gauge, bills, notes, and coins represent one to two percent of all exchanges in the United States. In 2018, the worth of cryptographic forms of money or blockchains was assessed to be USD 700 billion. As far as worth, Bitcoin is the most significant of these cryptographic forms of money.

There have been worries as of late that Bitcoin might redirect speculation from real estate. The justification for this is the chance of a 101 percent profit from interest in Bitcoin, albeit this stress is exaggerated. For various reasons, Bitcoin doesn’t address a danger to real estate investing. Regardless, real estate investing is safer. In contrast with real estate, the decentralization of the Bitcoin framework makes it an uncontrolled and obscure area for financial backers.

Second, there is less gamble of trickiness with real estate. Bitcoin tricks proliferate via online entertainment, and numerous clueless people are hoodwinked out of their assets by pyramid schemes including Bitcoin. Most of the time, this doesn’t have anything to do with Bitcoin; the extortion happens in its name. Laying out a bogus circumstance in real estate is troublesome.

Real estate venture is secure and reliable; the worth of real estate vacillates at a known rate. Bitcoin, then again, is extremely unstable as far as worth swings. Bitcoin has no duty benefits or derivations, which are normal in real estate. In rundown, Bitcoin investing isn’t an opponent to customary ventures.

Bitcoin as A Real Estate Investment

The ascent of cryptocurrency can help real estate. In the first place, digital currencies have delivered another class of rich people. These were principally early financial backers who were engaged with the IT area and jumped on board with Bitcoin. These people wish to put their recently gained bitcoin cash in the real estate market. As per this perspective, bitcoin will support real estate venture.

Another bitcoin advancement that benefits real estate is the utilization of cryptographic forms of money in real estate exchanges. There are a few benefits for the real estate industry to endeavor this. The most key is that bitcoin exchanges don’t need the inclusion of an outsider. At the point when one party gets a QR code from another, the exchange is finished. Banks or other monetary foundations are not expected to be involved. The straightforwardness with which this exchange might be finished will allure purchasers to put resources into real estate.

Some real estate experts might be worried about Bitcoin’s unstable nature. There are a few strategies that such people can utilize. They fix the Bitcoin rate to the pace of US dollars or Euros and acknowledge installment in these monetary forms, which permits them to stay away from Bitcoin unpredictability.

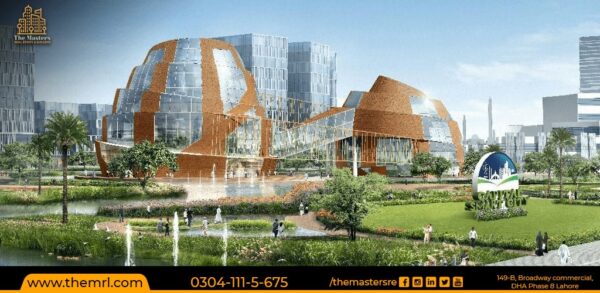

Individuals can then effectively buy property in Lahore Smart City utilizing this electronic cash.

The Next Steps

Indeed, even while bitcoin gives off an impression of being promising method for drawing in interest in the real estate market, it actually has quite far to go prior to being similar to paper cash. Bitcoin’s framework isn’t yet secure, and hacking is plausible. Accordingly, viable network protection measures are fundamental for Bitcoin and other digital currencies. At the same time, it should radiate a conviction that all is good.

One more wellspring of worry about Bitcoin’s ascent is the advanced gap. In Pakistan, most of individuals don’t approach the web. Furthermore, web clients are mostly confined to online entertainment and miss the mark on computerized understanding that bitcoin misrepresentation can turn into a squeezing issue. There, most importantly, is a need to advance media education prior to acquainting Bitcoin and other digital forms of money with Pakistan.

In a word, Bitcoin is a cryptocurrency or computerized money that works on a decentralized premise. With regards to the impact of digital forms of money on real estate investing, there are commonly two gatherings. One is frightened by it, while the other is blissful about it. Up to this point, it has been seen that the impact of digital currencies won’t take away from real estate speculation. Over the long haul, bitcoin can possibly increment interest in the real estate market. The new rich class that bitcoin has produced will put resources into real estate. Cryptocurrency may likewise be utilized to make real estate buys. It is too soon to foresee that bitcoin will change real estate exchanges. Accordingly, it ought to be treated with both good faith and mindfulness.

also read: https://themrl.com/capital-smart-city-islamabad/